Hot as a Recalled MacBook Battery

Hot as a Recalled MacBook Battery

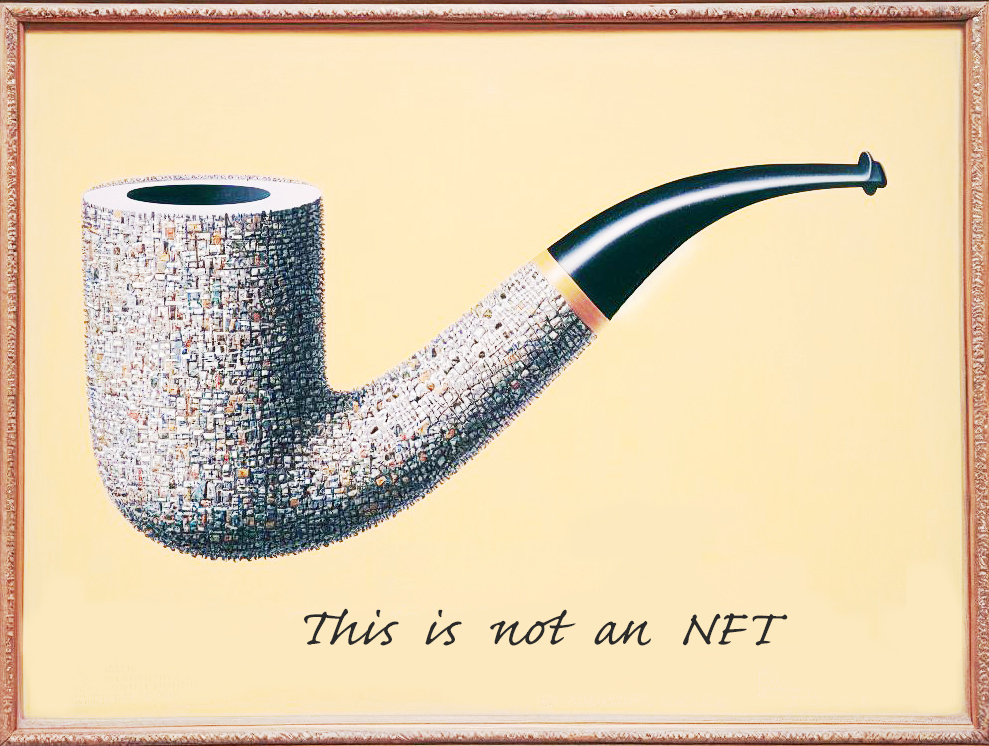

The non-fungible token market has become as hot as a recalled MacBook lithium battery (if that’s possible). You’ve probably seen the figures: digital artist Beeple sold an NFT for a remarkable $69 million; a LeBron James non-fungible dunk clip lasting ten seconds went for $200,000; Jack Dorsey’s first tweet  was auctioned for $2.9 million (though shortly after the sale, the tweet’s value plummeted 99% at a subsequent auction).

was auctioned for $2.9 million (though shortly after the sale, the tweet’s value plummeted 99% at a subsequent auction).

Various funds and exchanges now tally NFT transactions in the hundreds of millions of dollars.

The lucky beneficiaries of the market have surely taken into consideration federal taxes. But if they are nonresidents of California, they may not be thinking of how California might treat NFTs for tax purposes. Specifically, depending on the location of the buyer and the status of the seller, the income from NFT sales might be sourced to California, making it subject to California income tax. Oddly, in that case, due to favorable federal capital gains treatment of NFTs, it’s even possible that the California income tax might be higher than the federal tax. To add further complexity, NFTs are almost exclusively sold in exchange for cryptocurrency, adding cryptocurrency tax issues on top of the transaction.

What is an NFT?

People are used to non-fungible assets in the analog world: Action Comics #1 (the first Superman comic book), a stretch of beachfront real estate, the Mona Lisa. You might be able to copy these assets one way or another, but only the original has value. A snapshot of the Mona Lisa or a video of a beach house isn’t worth much. Hence, the non-fungible designation.

In contrast, media on the internet has always been susceptible to unlimited reproduction (whether in violation of copyright or not) without much loss in value. A copy of a YouTube video of Milli Vanilli has pretty much the same value, or lack thereof, as the original. Then came blockchain. The same public-ledger technology that authenticates bitcoin transactions can be used to validate the original digital file of a work of online art, or the NBA’s official slam-dunk competition clips, or Jack’s first, fateful tweet. Blockchain transformed digital media that could be infinitely reproduced with no significant diminishment of value, into a class of assets, like comic books or baseball cards, that could never be copied without a total loss of value. You can still copy an online version of an NFT as a screenshot or other facsimile. But the result is equivalent to a photo of the Mona Lisa. Continue reading

California Residency Tax Planning

California Residency Tax Planning